kLarna is reportedly looking to hire new staff for its customer service department.

The move comes after the Buy Now, Pay Later (BNPL) firm announced in 2024 plans to potentially halve its workforce with the technology as part of cost-saving measures.

But in an interview with Bloomberg, the company’s chief executive Sebastian Siemiatkowski admitted that Klarna’s AI-driven job cuts have “gone too far”, with the FinTech now testing a new cohort of staff “in an Uber-type of setup” that can log in and work remotely and take up customers’ requests as representatives of the bank.

Siemiatkowski also revealed that the business is planning a recruitment drive so that people using its customer services have the option of speaking to a real person rather than a chatbot.

“As cost unfortunately seems to have been a too predominant evaluation factor when organising this, what you end up having is lower quality,” Siemiatkowski said.

The chief executive also emphasised the importance of its human workforce for the company’s growth.

“Really investing in the quality of the human support is the way of the future for us,” he said.

Last August, the Swedish BNPL giant said in letter to shareholders it was planning a reduction of its workforce, flagging a move towards a more aggressive use of AI.

The FinTech, which cut its workforce from 5000 to 3800 during 2023, said it was expecting more dramatic reductions.

Klarna said that changes to its workforce were largely be attributed to natural attrition, including due to resignations, sickness, or retirement, but that AI would play a role in the next cutback.

The chief exec added at the time that the company’s AI assistant had a powerful role for its customer service arm, helping to further improve its shopping experience.

According to Klarna’s 2024 financial statement, the FinTech registered revenue growth of 27 per cent in the first half of the year.

Adjusted profits reached $66 million over the six-month-period, a sharp rise compared to adjusted loss of $45 million in the previous year. Siemiatkoski identified AI as a key driver of Klarna’s stronger results.

"Our AI assistant now performs the work of 700 employees, reducing the average resolution time from 11 minutes to just two, while maintaining the same customer satisfaction scores as human agents,” he said at the time.

Klarna currently serves 93 million active consumers and over 675,000 merchants, with the firm announcing this month it has reached over 11 million active customers in the UK.

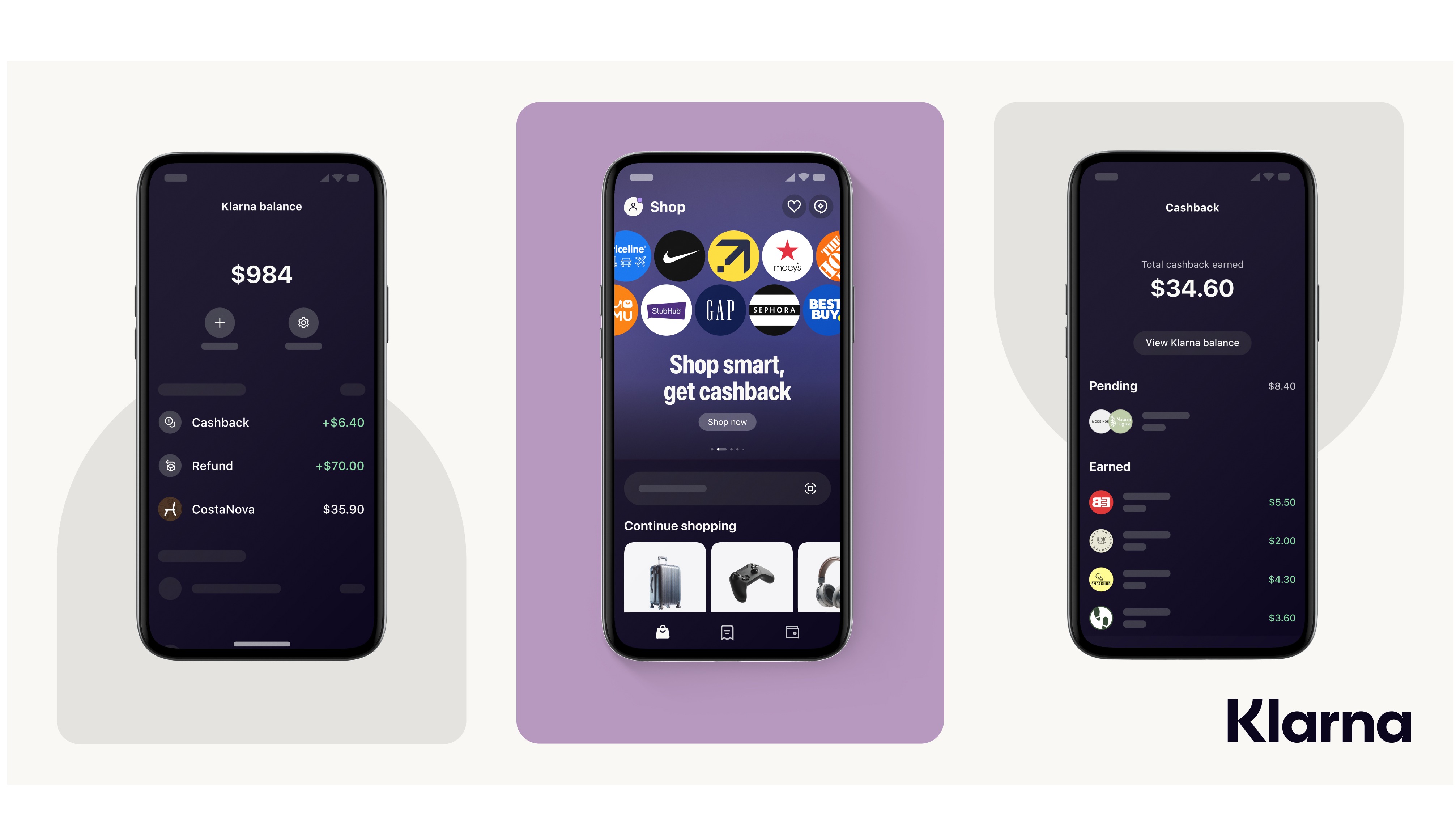

The company offers a range of services including flexible payments, delivery tracking and spending insights.

Last month, the FinTech signed an agreement with point-of-sale provider Clover to bring its services to businesses and shops in the US.

The partnership will initially enable around 100,000 merchants to offer flexible payment options for in-store purchases.

Latest News

-

Gap partners with Google to boost digital strategy with AI

-

Asda rehires Chris Chalmers for data and loyalty role

-

Kingfisher appoints Deba Sen as CCO

-

Iceland’s chair calls for government to take ‘shoplifting war’ seriously

-

Morrisons launches rapid ‘Morrisons Now’ delivery across hundreds of stores

-

Ikea-owner buys AI-powered logistics software firm to transform home delivery

Supermicro and NVIDIA’s AI Solution for Retailers

To find out more: click here

Beyond Channels: Redefining retail with Unified Commerce

This Retail Systems fireside chat with Nikki Baird, Vice President, Strategy & Product at Aptos will explore how unified commerce strategies enable retailers to tear down these barriers and unlock new levels of operational agility and customer satisfaction.

© 2024 Perspective Publishing Privacy & Cookies

.jpg)

Recent Stories